Builder's bust - Liquidator: ‘No money’ for $20M creditors

THE horrific fallout from the collapse Victorian-based building firm Langford Jones Homes, which operated extensively in the Bass Coast and South Gippsland areas, is still being calculated. Liquidators RSM Australia Partners Jonathon Colbran and...

THE horrific fallout from the collapse Victorian-based building firm Langford Jones Homes, which operated extensively in the Bass Coast and South Gippsland areas, is still being calculated.

Liquidators RSM Australia Partners Jonathon Colbran and Richard Stone advised last week that there is insufficient assets to pay any money to the more than 400 creditors owed in excess of $20 million.

“We advised creditors, that based on our initial assessment of the company’s assets, there is presently insufficient money to pay a dividend to creditors.

“Our investigations are ongoing and there are assets that still need to be recovered and realised but at this stage it’s not clear that there will be enough money to pay a dividend to creditors.

“This is obviously not the outcome anyone wants to see,” Mr Colbran said.

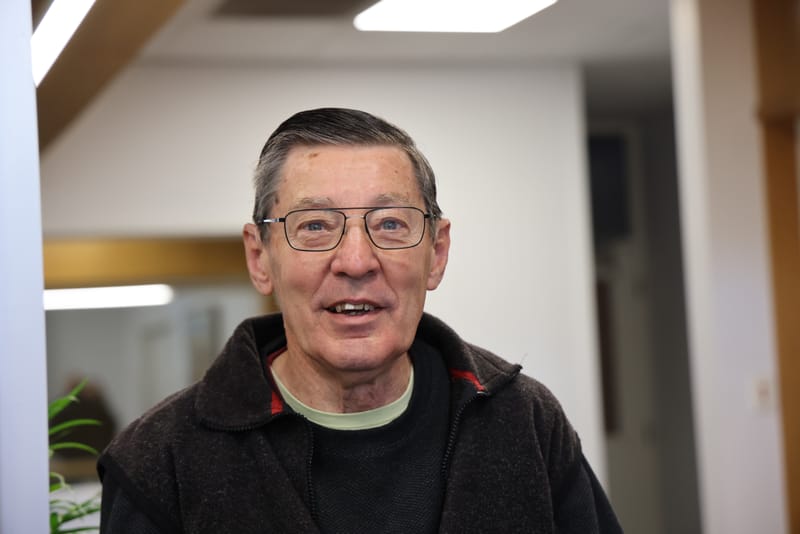

One of those creditors is Donna Taylor, a postie of San Remo who told A Current Affair last week that she was out of pocket $150,000 and had been left with a frame that is deteriorating in the weather.

“We’re just gutted, we’re angry. Absolutely devastated and angry that I have to just start again.

“We’ve done nothing wrong. I just don’t know why they didn’t stop earlier. There’s got to be a better way to protect the innocent,” she said.

Speaking to the Sentinel-Times this week, Ms Taylor said she was speaking out to highlight the impact of the builder's collapse, to support others in the same boat and to call on government to put better safeguards in place.

"This can't be allowed to happen to so many people who believe they are doing all the right things. I also feel for the dozens of tradesmen and businesses who have lost out in this. It's shocking."

The builders started Ms Taylor's project in November 2020 and she shelled out $150,000 for the first stage of work but by early the next year, work ceased and there’s now an empty frame left on the site with no roof.

“It’s a long road to working out what happens now. I’m going to have to keep working full time until I retire to pay off a debt I shouldn’t have to be paying off.

“I’ll have to start from scratch. I have to find out if the frame is viable to leave and if not get a roof put on it.”

The liquidators have revealed that there are many more like Ms Taylor.

“At the time Langford Jones Homes went into voluntary liquidation, 66 homes were under construction. These homes are predominantly located along the Bass Coast and within the communities of

San Remo and Phillip Island,” said Jonathon Colbran, a partner with RSM Australia.

“In addition, a further 60 projects had not commenced but paid deposits.

“While investigations into the final level of creditor claims is continuing, at this stage it appears that there are 354 ordinary unsecured creditors – including about 48 homeowners and more than 300 trade creditors, including suppliers and sub-contractors - allowed in excess of $12 million.

“In addition to these claims are loans that were made by members of the Langford-Jones family of $7 million which appear to have been used to support the business,” he said.

The details are evidence of the huge losses suffered by local tradies and building suppliers.

“Our investigations will consider a number of matters including the reasons for the Company’s failure, and whether any payments to third parties can be clawed back for the benefit of creditors,” Mr Colbran said.

“We will also be investigating whether the directors allowed the company to trade whilst it was insolvent and whether they may have breached their director duties, which if found to be proven, may result in a personal liability of the directors for at least some of the losses suffered by creditors.

“Our findings from these investigations will also be reported to the Australian Securities and Investments Commission (ASIC).”

The liquidators have been liaising with Langford Jones Homes staff, who were all made redundant, to assist them lodge claims under the Australian Government’s Fair Entitlement Guarantee (FEG) scheme.

“This scheme provides a safety net for the majority of employee entitlements and ensures that they are paid swiftly following the commencement of a liquidation which means they do not have to wait for recoveries to be made,” Mr Colbran said.

As part of their investigations, the liquidators have requested the books and records of a range of parties including external advisors, software providers, legal advisors, financial institutions, and the Australian Taxation Office.

Mr Colbran and Mr Stone will prepare a report to creditors that will be issued before September 30, 2022 detailing the results of their investigations. A meeting of creditors will then be held in October 2022 to discuss the report, the status of the winding up and proposed next steps.

For further information: Homeowners affected by the closure of Langford Jones Homes should contact Mr Vinod Karunasinghe via email at vinod.karunasinghe@rsm.com.au. Creditors should contact Anisha Maganty via email at anisha.maganty@rsm.com.au.