More of us losing money to investment scams

AUSTRALIANS lost over $205 million to scams between January 1 and May 1, a 166 per cent increase compared to the same period last year, according to new data from Scamwatch.

AUSTRALIANS lost over $205 million to scams between January 1 and May 1, a 166 per cent increase compared to the same period last year, according to new data from Scamwatch.

The true losses to scams are likely to be much higher, as our research shows that only around 13 per cent of people report their losses to Scamwatch.

The majority of losses over this period have been to investment scams with $158 million lost, an increase of 314 per cent compared to the same period last year.

While the reported losses have increased the number of reports has reduced slightly, indicating that on average people reported higher individual losses.

“We are seeing more money lost to investment scams and so are urging all Australians not to trust investment opportunities that seem too good to be true,” ACCC Deputy Chair Delia Rickard said.

The majority of losses to investment scams involved crypto investments, with $113 million reported lost this year. Cryptocurrency is also the most common payment method for investment scams.

“Australians should be very wary of anyone asking them to invest in or transfer money using cryptocurrency, especially if it’s someone you have only met online. Many consumers are unfamiliar with the complexities of cryptocurrency and this can make them more vulnerable to scams,” Ms Rickard said.

Scamwatch has also seen an increase in imposter bond scams this year, with $10.9m reported lost.

Imposter bond scams usually impersonate real financial companies or banks and claim to offer government/Treasury bonds or fixed term deposits.

Scamwatch data also shows scam contact methods are changing with text message up 54 per cent between January 1 and May 1 this year, surpassing phone call as the most common contact mode.

“If you receive an unexpected text message or phone call from someone offering you an opportunity to invest, it is likely a scam and you should immediately hang up or delete the message,” Ms Rickard said.

Phone scams have almost halved, suggesting the telecommunications industry’s Reducing Scams Call Code 2020 that blocks incoming calls from scammers is having an impact.

Since the Code’s introduction telco providers have blocked over 549 million scam calls, limiting opportunities for criminals to scam Australians.

New rules to block scam text messages will also be introduced this year.

People aged 55 to 64 reported the highest total losses, $32 million between January 1 and May 1 and over 80 per cent of losses reported by this age group was lost to investment scams ($26m).

Be vigilant as one member of the local community reported receiving two separate scam phone calls today under the guise of a fraudulent online transfer.

Warning on bank scams

The banks have been the target of a steady stream of scams, several of them seeking to catch out Commonwealth Bank customers via authentic-looking emails.

If you have to ask: “Is that really from CommBank?” don’t click! At the very least call the CommBank helpline on 13 22 21.

Here are a few more pointers:

* Remember, they'll never ask you for your banking information by email or text message

* Stop before you click

* If unsure contact CommBank immediately on 13 22 21 or visit a branch so they can assist you

* To be safe, always navigate directly to NetBank yourself and log on from the site you know to be genuine, rather than using any links in communications

* Report suspicious emails to hoax@cba.com.au then delete them straight after. Do not reply or engage with them

* Be aware that scams can also come via the telephone with people pretending to be from a reputable organisation who try and gain access to your computer, bank account and money. In this case the best thing you can do is hang up and call on an organisation’s officially listed phone number to verify the communication

Keeping your accounts safe is our priority. Find out more about how to recognise hoaxes and what to do if you see one.

Fraudulent emails

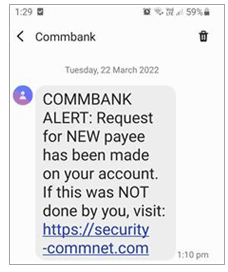

CommBank has seen a spate of CommBank-themed SMS phishing (fraudulent emails) targeting customers.

The SMS phishing varies in subject and includes telling people their accounts have been “placed under review”, or “new payees have been added,” or a CommBank account “has been registered on a new device”.

All are designed to trick people into clicking a link and then providing their login credentials.

These are not genuine CommBank emails. Do not click the link or engage with the message.

If you have made a mistake and already done so, call the bank straight away on 13 22 21.

‘Your account is temporarily suspended’

A number of CommBank-themed phishing emails and SMS are currently in circulation.

These fraudulent communications inform recipients that their NetBank has been, or will be, stopped or restricted if they fail to login by clicking on a malicious link within the email and updating their details.

This is not a genuine CommBank communication. Do not click the link or reply to the sender.